While comprehensive health insurance is essential, fees can be concerning. Monthly premiums, copays, and coinsurance can all add up. However, there are potential solutions for Medicare members to lessen high-pocket costs.

Medicare Supplement plans, Medigap, can effectively cover costly medical expenses. With proper information, you can better understand what the supplemental is and the benefits it can have. In this article, we will discuss everything you need about Medigap and answer the question, “Do I need supplemental insurance with Medicare?

What is Medicare Supplemental Insurance (Medigap)?

Medigap is offered through private insurance companies, unlike Medicare, which is federally administered. It is important to note that you must be enrolled in Original Medicare Part A and Part B to be eligible for Medicare Supplemental Insurance. As the name implies, Medigap is meant to fill in the gaps that Original Medicare does not cover.

In particular, Medigap can help cover out-of-pocket expenses such as copayments, coinsurance, and yearly deductibles. However, it will not typically provide coverage for long-term care. While Medicare has only four parts, Medigap offers ten different plans.

Medicare Advantage and Medicare Supplement Plans have certain similarities. Both are sold by Medicare-approved private insurance companies and aim to reduce out-of-pocket costs from expensive medical bills. However, there are key differences.

Medigap provides more predictable expenses like monthly premiums. Furthermore, depending on your residence, Medigap may offer a broader range of coverage accessibility. Conversely, Medicare Advantage includes prescription drug coverage while Medigap policies don’t. You must enroll in Medicare Part D to receive prescription drug coverage with Medigap.

Two Reasons Why You Need Supplemental Insurance

Supplemental Insurance has many benefits. It’s an excellent option for self-employed individuals or retirees without employer-sponsored insurance. You can receive a quote online to understand fees like monthly premiums better. Medigap is an effective way to receive greater health coverage while lowering out-of-pocket expenses.

More Health Coverage

Medigap expands on Original Medicare and provides additional coverage. For example, you can visit any primary care provider that accepts Medicare. Furthermore, you do not need a referral to see a specialist. This type of health insurance plan is most beneficial for those who want flexibility in their coverage.

In addition, if you are a frequent traveler, Medigap may be right for you as these supplemental insurance plans offer nationwide coverage. Under this option, you are not limited to care providers and healthcare facilities in your local area. However, it is important to note that Medigap plans do not offer prescription drug coverage. To receive those benefits, you must sign up for a Medicare Part D prescription drug coverage plan.

Save You From High Out-of-Pocket Medical Expenses

While you are required to pay monthly premiums, a Medigap plan can lower pocket expenses. Your monthly premiums may vary since these plans are sold through private insurance companies. It can be beneficial to speak with a licensed insurance agent as they can answer any questions or concerns you may have.

Although long-term care benefits are not offered by Medigap policies, they can significantly lessen pocket costs from Original Medicare. In particular, these plans provide coverage for deductibles, copayments, and coinsurance. When considering Medigap, you should consider your medical history and circumstances. Medicare supplemental insurance plans can be quite beneficial for those who require more frequent and intensive medical care. If the additional costs of Medigap lower your overall out-of-pocket costs, it is worth getting.

What Medigap Policies Cover

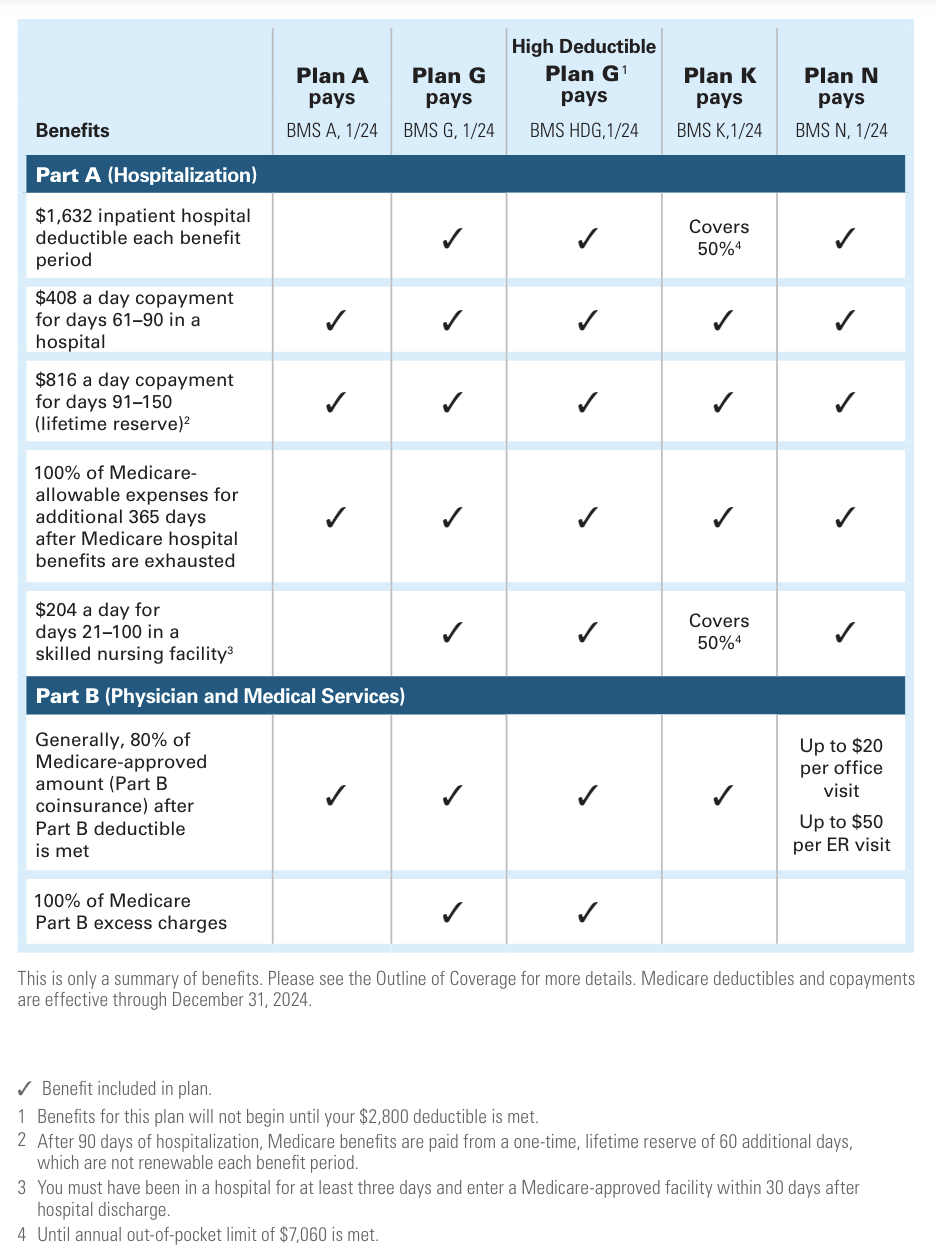

As previously stated, ten different Medigap plans are available, each with different coverage options.

It should be noted that Medigap policies do not provide coverage for long-term care, dental care, or prescription drug coverage. In addition, after reaching your Medicare Part B pocket costs limit, Medigap Plans K and L will fully pay for all covered medical expenses. Furthermore, depending on the state you live in, Medigap Plans F and G offer high-deductible plans. Under this option, you will pay a lower monthly premium but have a higher yearly deductible. These plans can be quite beneficial if you do not require frequent doctor visits.

Eligibility For Supplemental Insurance With Medicare

To begin, these supplement plans are only available for Original Medicare members. If enrolled in Medicare Part C (Medicare Advantage), you are not eligible for Medigap until you cease Medicare Advantage coverage. It’s important to note that as of January 1st, 2020, Medigap Plan C and F are no longer available for newly eligible Medicare members. Those plans would still be available if you were Medicare-eligible before January 1st, 2020.

Typically, it is best to enroll in Medigap once you turn 65 years old. You must send an application to your choice of Medicare-approved private insurance companies. There is a six-month Open Enrollment Period. You cannot be denied coverage even with pre-existing health conditions during this time. If you fail to enroll within the open enrollment period, you may be subject to higher fees. In certain instances, the private insurance company may refuse to sell a Medigap plan if you have a pre-existing medical condition.

How Much Will Supplemental Insurance (Medigap) Cost?

As it relates to cost, there are three policy pricing methods. They are: community-rated, issue-age-rated, and attained-age-rated. Depending on your state of residence, different methods may be implemented. Therefore, it is essential to understand what these pricing policies mean and how they can impact your monthly costs.

Community-rated means that age is not factored in when determining monthly premiums. Typically, everyone will be charged the same.

Moving on, issue-age-rated policies determine your monthly fees based on when you first enrolled. For example, an individual who signed up for Medigap at 65 will pay less than someone who signed up at 70.

Finally, attained-age-rated means that your monthly premium will increase each year. Individuals who begin coverage at an older age typically pay higher initial costs.

Since they are sold by private insurance companies, Medigap plans can vary in price. The same plan can be offered at two different prices. You should consider working with a licensed insurance agent. They have the experience and knowledge to help you understand different Medigap plans and their potential costs.

Frequently Asked Questions

Is there a Medicare supplement that covers everything?

Unfortunately, there is no singular Medicare supplement plan that covers everything. Each has its own benefits and coverage options.

What’s the difference between a Medicare supplement plan and Medicare?

Medicare is your primary health insurance plan. They will provide coverage for hospital and medical bills. A Medicare supplement plan, like Medigap, helps pay for out-of-pocket costs.

What is the highest-rated Medicare supplement company?

As stated by Investopedia, Blue Cross Blue Shield offers the highest-rated Medigap plan types.

What is the downside to Medicare supplement plans?

Medicare supplement plans require monthly premiums. Prescription drug coverage and long-term care are typically not provided.

What is the best Medicare Supplement insurance policy?

Generally, Medigap Plans F and G offer the most comprehensive coverage. However, after January 1st, 2020, Plan F is no longer available for new Medigap members. Therefore, Plan G provides extensive benefits for new and long-time members.

Here’s How You Can Learn More

To schedule an appointment with Health Plans of NC, please call 800-797-0327. Our office is open Monday through Friday from 8 AM to 5 PM. We look forward to helping you find the right Medicare supplemental insurance plan.