5 Questions To Ask Before Picking A Health Insurance Plan

Health insurance can be complicated. Whether you’re purchasing health insurance for the first time or just needs some help navigating the marketplace, we have the answers to your most pressing questions.

Blue Cross NC

Health insurance can be complicated. Whether you’re purchasing health insurance for the first time or just needs some help navigating the marketplace, we have the answers to your most pressing questions.

1. When can you buy health insurance?

If you buy your health insurance through the marketplace, not through your employer, there are a few times you’re able to purchase a plan. The first is during Open Enrollment, which occurs each November and runs through December 15th.

The second is if you experience a qualifying life event, these are things like getting married, changing jobs or having a baby. If you experience one of these events your health insurance enrollment options re-open and you can re-select or opt in for a different plan.

2. Why do you need health insurance?

Health insurance is like a safety net. You may not need it, but in the event you do, you’re happy to have it. No one expects to get sick or have surprise medical bills but having health insurance can give you peace of mind. In fact, you may even be surprised at all the ways health insurance can help you save and all the things it may cover.

Three members recently shared their stories on how health insurance helped them in their time of need. Take a read:

Kate received a high-tech prostatic arm that changed her life for the better.

Margaux saved almost $500,000 in medical expenses while treating her cancer

3. How much coverage do you think you’ll need?

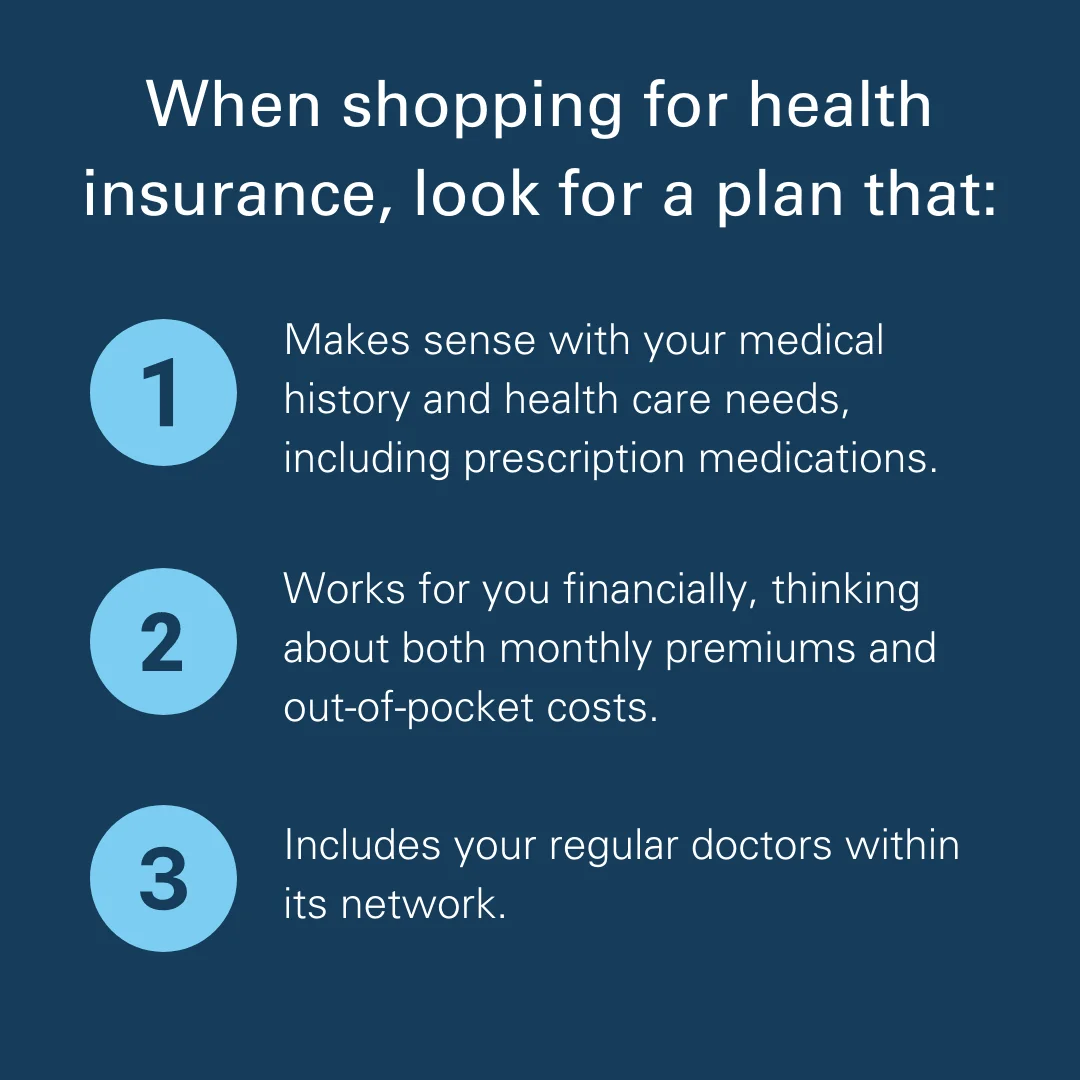

Consider your personal health needs and the amount of care you typically use.

A bronze plan is good for people who want protection from worst-case medical scenarios, like a serious illness or injury. This type of plan can have low monthly premiums but pays less of your costs when you need care.

A silver or gold plan will have higher monthly premiums. These plans will cover more of your routine care and regular prescription drug costs.

4. What are the costs associated with each plan?

When shopping for a plan, there are two types of costs to consider. One is your premium, or the amount that you pay your insurance company each month.

The second is your out-of-pocket expenses. These are things like co-pays, deductibles, and any other costs not covered by your insurance plan.

Together these costs make up your total health care expenses. It’s important to consider both your monthly payment and your expected medical expenses when choosing a plan.

Many people and families qualify for savings on their monthly premiums based on income. Find out if you qualify and apply for your subsidy through healthcare.gov.

5. Which doctors do you see?

Check to see if any doctors you regularly use are in-network for the plan you’re considering. This is important because seeing in-network doctors will cost you less than seeing out-of-network doctors.

Remember that with Blue Cross and Blue Shield of North Carolina, you’ll never need a referral to see a specialist. As part of our efforts to keep costs down, Blue Cross NC works closely with many North Carolina hospitals and physicians to help get you access to quality, affordable care, when you need it.

_________________________________

Ready to get started?

Related Articles

4 Reasons You Should Use A Health Insurance Agent

Health Plans of NC Staff

Do I Need a Health Insurance Agent?

Health Plans of NC, Kelly Quinn

Why Choose A Local Health Insurance Agent

Heath Plans of NC, Kelly Quinn